Mortgage for non-citizens using ITIN number

A huge challenge for people that are not citizens in the US, nonresident aliens, is applying for a mortgage. Individuals that are not U.S. citizens and are self-employed required to file taxes. This process is done by getting an ITIN number from the IRS using a W7 form.

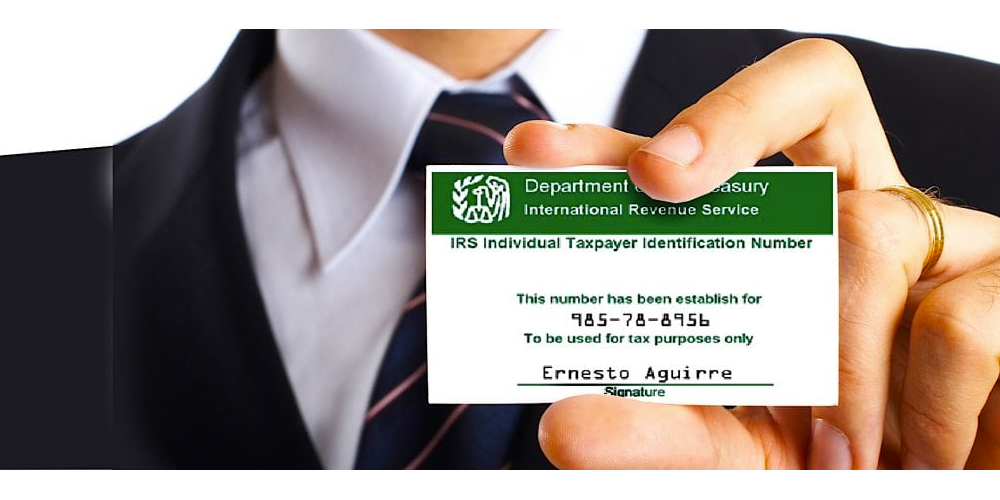

Not having a social security number makes it difficult for non-resident aliens to get a mortgage, due to the lack of not having a social security number. Even if income is earned and taxes are filed. Our ITIN Loan program is perfect for individuals that DO NOT HAVE A Social Secuirty Number (SSN) but have an ITIN Number. In case if you’re wondering if you have an ITIN number, check the first number and fourth number. The first number has to be a 9 and the fourth digit is a 7 or an 8.

What you’ll need:

The ITIN proof that is needed is a valid ITIN card or a IRS ITIN letter. As well as a valid passport.

Eligibility is also based on income qualification:

- 2 years of tax returns

- 2 months of pay stubs

- A year to date profit and loss statement (P&L Statement)

- A business license from your CPA or a letter from a CPA documenting a minimum of 2 years employment.

There are additional credit and reserve requirements for this program. A credit report will be pulled using the ITIN number as well and additional credit lines may be needed for qualification purposes.